Cerrar

A continuación, demostramos cómo sacar el mayor provecho de los pronósticos de Datup para aumentar los niveles de precisión y disminuir los tiempos de entrega en la planeación de la demanda. Para ello, se describirán los journey y escenarios de uso básico, intermedio y avanzado.

Estos casos de uso le permitirán al analista tomar en consideración diversos campos de los cubos de resultados, que orienten de mejor manera la toma de decisiones, con respecto al comportamiento de la venta, demanda, abastecimiento o similares.

Este caso de uso orienta la toma de mejores decisiones para:

Conocer el volumen de demanda requerido por los clientes por cada item para uno o más meses futuros.

Proponer en sesiones de S&OP volumenes de demanda acordes a condiciones optimistas, conservadores o pesimistas de ventas.

Evaluar el margen de certeza o incertidumbre de los pronósticos de demanda.

Priorizar el pronóstico del portafolio por los items de mayor venta, rotación y variación en la demanda.

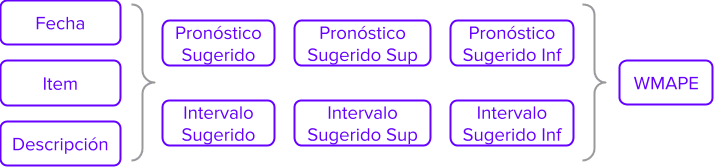

Este escenario se centra en los pronósticos sugeridos, generados y seleccionados automáticamente por la plataforma. En primer lugar, se debe ubicar la fecha y el ítem de interés, por medio de las columnas Fecha e Item, respectivamente. La columna Pronóstico Sugerido muestra el pronóstico sugerido para la fecha y el ítem bajo análisis, con base en el comportamiento histórico de la demanda (Demada Histórica); considerando estacionalidades, niveles, tendencias e incluso relaciones con otros ítems del portafolio.

Adicionalmente, se incluye la columna Pronóstico Sugerido Sup, la cual presenta un escenario alternativo al pronóstico sugerido cuando existen indicios o se anticipa un alza sustancial en demanda del ítem para el período específico. El Pronóstico Sugerido Sup suele ser de gran utilidad para las sesiones de S&OP, donde la contraparte de comercial suele concertar valores más altos para los pronósticos de ciertos ítems, sujetos a campañas de marketing o estrategias de mayor consumo. En lugar, de abrir el espacio a la especulación para esa posible demanda de mayor nivel, la plataforma ofrece un valor alternativo que contempla ese escenario de sobredemanda. Por otro lado, la solución también presenta un valor alternativo para el escenario de subdemanda, donde la contraparte comercial preve una destimulación en el consumo del ítem para los períodos futuros. El campo Pronóstico Sugerido Inf contiene la cantidad de demanda a considerar.

El campo WMAPE, permite conocer el error esperado para el período pronosticado, con base en los errores obtenidos al realizar pruebas de backtests, es decir, de simular el pronóstico de la demanda para períodos anteriores, donde se conoce el comportamiento real, por ende es posible medir el desempeño. Por defecto, en Datup se realizan 5 de estas simulaciones o backtests en cada iteración de los modelos.

Por último, se sugiere tener en cuenta la columna Ranking, la cual permite determinar los ítems de mayor, consumo, rotación y estabilidad en demanda. En otras palabras, permite identificar cuales son los ítems de mayor y menor valor para el negocio.

Este uso orienta la toma de mejores decisiones para:

Todas las ventajas del journey básico.

Conocer los ítems sobrepronosticados de forma recurrente con respecto a su histórico de demanda para prevenir pérdidas por inventario excesivo.

Conocer los ítems subpronosticados de forma recurrente con respecto a su histórico de demanda para prevenir pérdidas por agotados o quiebres de inventario.

El segundo escenario acompaña los pronósticos sugeridos con los intervalos sugeridos, permitiendo al analista de la demanda conocer los ítems con sub o sobrepronósticos consistentes en el pasado. La columna Intervalo Sugerido indica el intervalo de pronóstico asociado con el pronóstico sugerido en la columna Pronóstico Sugerido. En consecuencia, los pronósticos sugeridos al alza (Pronóstico Sugerido Sup) y a la baja (Pronóstico Sugerido Inf) también están acompañados por sus intervalos sugeridos Interval Sugerido Supy Intervalo Sugerido Inf, respectivamente.

Los intervalos de pronóstico Intervalo Sugerido, Intervalo Sugerido Sup y Intervalo Sugerido Inf, no solo son calculados para los períodos a pronosticar, sino también para cada período de backtest o simulación. Es precisamente de esta manera como es posible determinar cuál es el intervalo de pronóstico, y por ende, el pronóstico sugerido más probable, según su repetición en la historia de demanda observada.

De manera práctica, el analista o planeador de la demanda puede determinar si un ítem es susceptible de sobredemanda, si el intervalo sugerido Intervalo Sugerido tiene uno de los siguientes valores: Lo95, Lo80 o Lo60. Por el contrario, el ítem es susceptible de sobredemanda si el Intervalo Sugerido presenta bien sea Up60, Up80 o Up95. En ambos casos, la sobredemanda se establece con respecto al pronóstico punto que se ubica en la mitad de todos los intervalos de pronóstico.

Usar los intervalos de pronóstico permite al proceso de planeación de la demanda anticipar y evitar eventos de sobreproducción o sobrebastecimiento, así como agotados o quiebres de inventario.

Este uso orienta la toma de mejores decisiones para:

Todas las ventajas del journey intermedio.

Examinar los pronósticos ingenuos, es decir promedios o últimas observaciones, para planear la demanda en ítems de alta variación o intermitencia y aumentar su precisión.

Examinar los pronósticos sugeridos por cada ítem y período para conocer que tan alto o bajo puede comportarse la demanda ante diferentes circunstancias del mercado

Evaluar el error MASE para determinar en qué casos es aconsejable utilizar pronósticos ingenuos para aumentar la precisión de la planeación.

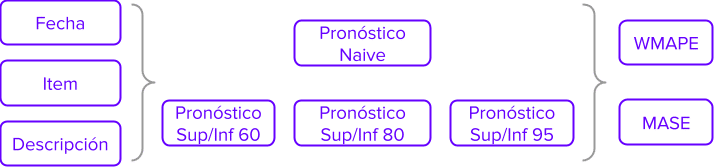

El tercer y último escenario involucra el pronóstico ingenuo y todos los pronósticos asociados los intervalos de pronóstico estimados por Datup. Esta colección de valores permiten al analista conocer todos los posibles escenarios de altos y bajos en la demanda pronosticada.

Los pronósticos punto Pronóstico Punto, inferior 95 Pronóstico Inf 95, inferior 80 Pronóstico Inf 80, inferior 60 Pronóstico Inf 60, superior 60 Pronóstico Sup 60, superior 80 Pronóstico Sup 80 y superior 95 Pronóstico Sup 95 componen la totalidad de puntos que estima Datup por cada fecha e ítem para considerar los diferentes escenarios de alta, media y baja demanda. El algoritmo se encarga de seleccionar automáticamente el escenario, y a su vez el valor más probable. Sin embargo, en el cubo de resultados se presentan de forma abierta al analista para habilitar posibles ejercicios adicionales.

Por su parte, el pronóstico ingenuo en la columna Pronóstico Naive calcula el valor del pronóstico por medio de un promedio por ventana movible. El tamaño de la ventana coincide con el número de períodos a pronosticar. Por ejemplo si se desea pronosticar 4 semanas, la ventana movible calcula el pronóstico ingenuo tomando el promedio de 4 semanas a la vez de la historia. Datup compara el desempeño de su modelo contra el pronóstico ingenuo, ya que existen ítems cuya estabilidad en la historia de la demanda sufre de altas intermitencias y/o compartamientos aleatorios que impiden su pronóstico a través de métodos estadísticos tradicionales o avanzados. El valor de la columna MASE muestra el resultado esta comparación. Los valores cercanos a 1 (por encima o por debajo) confirman el rendimiento superior del modelo de Datup, mientras valores muy superiores a 1, favorecen el uso del pronóstico ingenuo Pronóstico Naive. Si este es el escenario, en el cubo, el pronóstico ingenuo será el valor sugerido como pronóstico para el periodo evaluado.

Este journey orienta la toma de decisiones para:

dentificar las variables o indicadores que tienen mayor impacto en el pronóstico de uno o varios items de interés. Los cambios al alza o baja en las variables asociadas son más probables de producir variaciones significativas en los pronósticos de la planeación.

Determinar las variables o indicadores correlacionados con los items de interés. Es decir, las variables cuyos cambios al alza o baja producen cambios en los Ítems de interés, en la misma proporción.

Determinar las variables o indicadores causales a los ítems de interés. Es decir, las variables cuyos cambios al alza o baja suponen una causa directa para el comportamiento futuro de los ítems de interés.

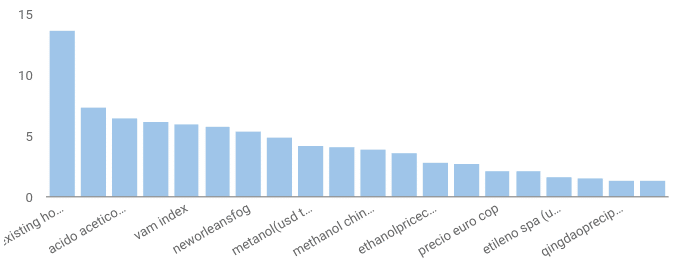

En conjunto con la planeación de demanda, es posible conocer los items, variables o indicadores que tienen mayor impacto en los pronósticos, acompañados por un porcentaje de importancia; a mayor porcentaje es mayor la importancia de la variable. Datup identifica y ordena automáticamente las variables determinantes en la planeación. De esta forma, los analistas pueden centrar sus esfuerzos en el seguimiento de indicadores claves, cuyos cambios tienen una influencia directa y considerable en los pronósticos. En el ejemplo de la gráfica, se observa como US Existing Home Sales es el indicador de mayor importancia para los pronósticos generados con 15% de participación, seguido por los indicadores: Acetic Acid Index (7.4%), Acido Acético RMB (6.4%) y US Ethanol Price (6.2%). Así, los analistas pueden identificar entre cientos de variables, cuáles son el top-n que realmente influyen en los precios de compra, cantidades de ventas o unidades de demanda para los períodos futuros, con el fin de poner en marcha estrategias anticipadas de negociación, compras, producción o distribución mejor dirigidas.

La correlación aporta un segundo criterio en la selección de las variables o indicadores que merecen mayor atención en los procesos de toma de decisiones para compras, negociación, producción o distribución, ya que determina cuales son las variables cuyos tendencias al alza o a la baja generan un comportamiento directo o inverso en un item de interés. En general, las variables con una correlación directa entre 0.7 y 1 o una correlación inversa entre -1 y -0.7, merecen ser tenidas en cuenta. En este caso, el item o indicador de interés es el precio de compra de la materia prima Vynil Acetate Monomer (VAM). Los indicadores directamente correlacionados son: Price VAM ADC (0.9), VAM Index (0.86), Acetic Acid Index (0.85) y Acido Acético RMB (0.85). A este punto, se debe prestar especial atención a aquellas variables que aparecen con altos porcentajes de importancia y altas correlaciones, es decir Acetic Acid Index y Acido Acético RMB, ya que sus variaciones al alza producirán, aún más probablemente, variaciones al alza también en el precio del VAM. Es importante revisar si existen variables con altas correlaciones negativas (-1 a -0.7), ya que pueden indicar un comportamiento inverso, un alza en la variable indicará una tendencia a la baja en el Price VAM. En el presente ejemplo no se registran variables inversamente correlacionadas.

Finalmente, se tiene la causalidad como último criterio en el análisis y selección de variables importantes en los pronósticos de precios, ventas o demanda. La causalidad, a diferencia de la correlación, permite establecer una relación de causa-efecto entre un grupo de variables e indicadores y los items de interés. Con base en los pronósticos, Datup de determina cuales son las variables cuyos comportamientos son la causa de los cambios al alza o a la baja de los items objetivo. Por ejemplo, se observa que los pronósticos del precio del VAM son causados mayormente por el Methanol China Index (0.5), New Orleans Temperature (0.39), Acetic Acid Index (0.35), Qingdao Temperature (0.31), US Price Ethanol (0.31). Una vez más, es importante prestar atención a aquellas variables comunes al análisis de impacto, correlación y causalidad, ya que conforman el conjunto de indicadores claves a tener en cuenta por los analistas para sus decisiones operativas y estratégicas. Aquí, el Price Ethanol es identificado tanto en el análisis de impacto, como causalidad. Aún más relevante, el Acetic Acid Index es el común denominador en los 3 análisis de importancia.

De esta forma, los indicadores claves por orden de importancia para guiar las estrategias de compra del Price Vynil Acetate Monomer (VAM), seguiendo los criterios de impacto, causalidad y correlación son:

Acetic Acid Index

Acido Acético RMB

US Ethanol Price

US Existing Home Sales

Methanol China Index

New Orleans Temperature

Qingdao Temperature

Por último, se debe anotar que cada nuevo pronóstico diario, semanal o mensual conlleva la estimación de las variables e indicadores de alto impacto, causales y correlaciones, con base en los cambios observados en los datos recolectados más recientemente. Datup se encarga de automática y continúamente identificar y presentar a los analistas el top-n de indicadores claves a tener en cuenta para la mejor toma de decisiones de negociación, compras, producción o distribución.

Este caso de uso orienta la toma de decisiones para:

Simular el comportamiento de items de interés, con base en el incremento, sostenimiento o disminución en los valores de variables e indicadores específicos.

Tomando como punto de partida los indicadores identificados de alto impacto, causales y/o correlacionados por el análisis de importancia de Datup, es posible pronosticar la cantidad o precio de un item de interés en los períodos futuros. A diferencia de los pronósticos de la primera parte, la simulación no solo considera los históricos, sino también construye diversos escenarios a partir de los indicadores claves para generar los pronósticos de los items de interés; cubriendo aumentos del 10% y 30%, caídas de -10% y -30% o la permanencia del valor actual. Adicionalmente, a los indicadores postulados por el análisis de impotancia, los analistas pueden incluir variables adicionales a simular.

En el caso de uso de ejemplo, el Price Vynil Acetate Monomer (VAM) es el item de interés, los indicadores claves a simular son: Acido Acético RMB, US Ethanol Price, US Existing Home Sales. Además, se incluyen los indicadores de apoyo Dólar TRM y WTI Crude USD en la simulación.

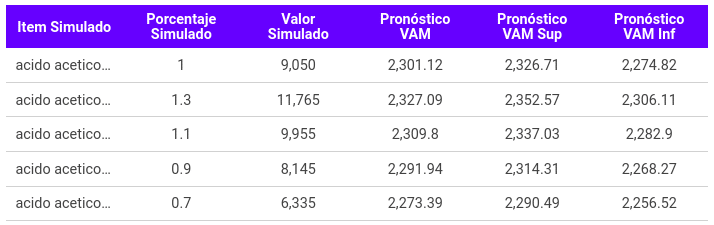

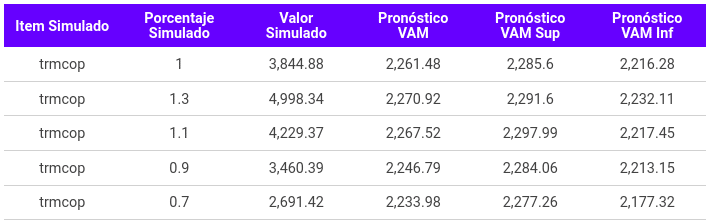

En los resultados, se observa la simulación de 5 escenarios que puede presentar el Acido Acético RMB en los pronósticos de corto plazo, los cuales corresponden a aumentos del 10% ($9.995) y 30% ($11.765), caídas de -10% ($8.145) y -30% ($6.335) y la permanencia del precio actual ($9.050). Para cada escenario, Datup pronostica el Price VAM más probable en la columna Pronóstico VAM, acompañados del precio techo Pronóstico VAM Sup y piso Pronóstico VAM Inf donde se puede ubicar, según las incertidumbres observadas en su histórico. Por ejemplo, si el Acido Acético RMB aumenta un 10% su precio actual alcanzando $9.995, el Price VAM se ubicará en $2.309, con techo en $2.337 y piso en $2.282.

Ahora, tomando el Dólar TRM como una de las variables a simular, se considera el escenario donde la tasa de cambio baja un 10% para ubicarse en $3.460. De esta forma, el Price VAM se ubicará en $2.246, con techo en $2.284 y piso en $2.213.